2 - Time Value of Money

Table of Contents

- TIME VALUE OF MONEY

- Simple Interest

- Compound Interest

- Formula for Calculating Compound Interest

- Fun Formulas

- FV Tables

- Annuities

- FV of an Annuity Tables

- Present Value

- Present Value Tables

- The Most Fun Formulas

- PV of an Annuity Tables

- Intrayear Compounding

- Intrayear Compounding (Example)

- Annuities Dues

- Perpetuity

- Perpetuity Example

- Practice

Text and Images from Slide

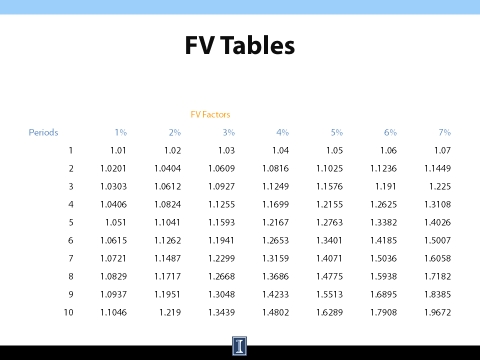

FV Tables

| FV Factors | FV Factors | ||||||

|---|---|---|---|---|---|---|---|

| Periods | 1% | 2% | 3% | 4% | 5% | 6% | 7% |

| 1 | 1.01 | 1.02 | 1.03 | 1.04 | 1.05 | 1.06 | 1.07 |

| 2 | 1.0201 | 1.0404 | 1.0609 | 1.0816 | 1.1025 | 1.1236 | 1.1449 |

| 3 | 1.0303 | 1.0612 | 1.0927 | 1.1249 | 1.1576 | 1.191 | 1.225 |

| 4 | 1.0406 | 1.0824 | 1.1255 | 1.1699 | 1.2155 | 1.2625 | 1.3108 |

| 5 | 1.051 | 1.1041 | 1.1593 | 1.2167 | 1.2763 | 1.3382 | 1.4026 |

| 6 | 1.0615 | 1.1262 | 1.1941 | 1.2653 | 1.3401 | 1.4185 | 1.5007 |

| 7 | 1.0721 | 1.1487 | 1.2299 | 1.3159 | 1.4071 | 1.5036 | 1.6058 |

| 8 | 1.0829 | 1.1717 | 1.2668 | 1.3686 | 1.4775 | 1.5938 | 1.7182 |

| 9 | 1.0937 | 1.1951 | 1.3048 | 1.4233 | 1.5513 | 1.6895 | 1.8385 |

| 10 | 1.1046 | 1.219 | 1.3439 | 1.4802 | 1.6289 | 1.7908 | 1.9672 |